Welcome to March 2024 edition of the XIIth volume of Carnival of Quality Management Articles and Blogs.

The theme for the XIIth volume of our Carnival of Quality Management Articles and Blogs is The Defining Trends of Quality Management – Raising The Bar.

For the present episode, we will take up managing the enterprise risks in the changing environment.

With the implementation of ISO 9001:2015, risks and opportunities have become the cornerstone of ISO standards. These standards define risk as “the effect of uncertainty on objectives, whether positive or negative.” This definition shifts the understanding of risk away from the possibility of a negative outcome and toward the uncertainty itself.

The world today is in the throes of permacrisis – a world in permanent crisis, grappling with profound, persistent, ongoing challenges.[1]

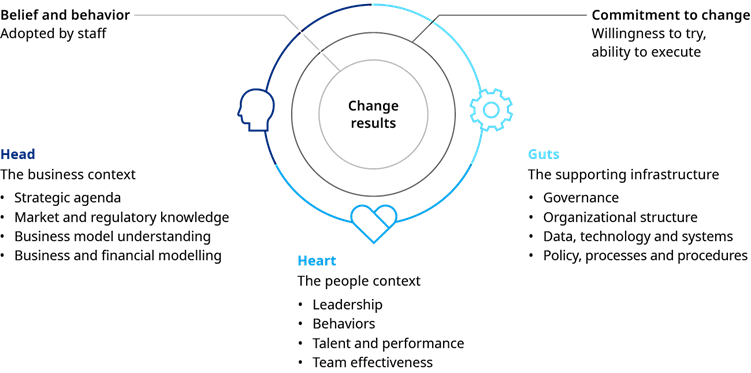

In the present-day world, the uncertainty comes not only from the changes but the rate at which these changes happen. The firms able to effectively deliver change will thrive and are more likely to emerge stronger from these changes. Effective change boils down to directing energy and aligning efforts toward three key elements:[2]

- The strategy and thinking (The Head)

- The people and behaviors (The Heart)

- The underlying infrastructure (The Guts)

The types of risks are normally classified as:

Of these risks, financial, economic and technological risks are the domains of specialists in the respective field. So, we will not include these in the discussions here. We ill take up the other three types – strategic, compliance and operational risks for brief discussion in the next episodes.

And, of course, the one related to climate change risks, too.

Further reading:

-

- Risk management – Harvard Business Review

- Managing risks in changing market landscape

- Business Resilience – The world is experiencing a level of disruption and business risk not seen in generations. Some companies freeze and fail, while others innovate, advance, and even thrive. The difference is resilience. : Institutional Resilience | Financial Resilience | Operational Resilience | Technological Resilience | Organizational Resilience | Reputational Resilience | Business Model

- The future of risk: New game, new rules

- Resilience – When disruptions are ever present, organizations need the ability to respond to and recover from unforeseen challenges to get back to thriving. This resilience has become a key organizational attribute—and a skillset in its own right.

- Risk management and compliance can do more than mitigate threats and safeguard a company’s operations and reputation—it can create value.

- Future of Risk

- Risk Management Forecast for 2024: Defining Trends and Ways to Prepare

We will now turn to our regular sections –

@ ASQ TV, we will listen to 2023 Most Viewed. The top one was Quality Culture.

More Material on the subject @ Culture

Finally, we take up the article Quality Headline: ISO now REQUIRES management to consider “climate change’ in your MSS By Roderick A Munro – Effective immediately, all MSS requirements have added two new statements to organization’s current registration.(These can be found across 35 standards with the notation of “Amd 1:2024 (amendment)” and are free to download..)

The additions are:

4.1 – Add the following sentence at the end of the subclause:

“The organization shall determine whether climate change is a relevant issue.”

4.2 – Add the following note at the end of the subclause:

“NOTE 2 Relevant interested parties can have requirements related to climate change.”

It appears that ISO has also released several free publications talking about how ISO is working with worldwide stakeholders to address climate change. Some of the free downloads include:

PUB100449 Climate change adaptation

PUB100271 Environment Climate Change mitigation

PUB100067 ISO and climate change

Climate action toolkit: case studies

I look forward to your views / comments / inputs to further enrich the theme of The Defining Trends of Quality Management – Raising The Bar.

Note: The images or video clips depicted here above are through courtesy of respective websites who have the copyrights for the respective images /videos.

[1] Enterprise Risk Management (ERM) Trends in 2024

[2] Managing change risk – Ramy Farha, Chris DeBrusk, and Antonio Tugores

The most prevalent change that the advent of 21st century has witnessed is the extremely dynamic rate of change. If change was the constant of later part of 20th century, it is almost becoming beyond human comprehension rapid rate of change that is becoming the new-normal with passing of every year of the present century. This rapid change is making what w=is already ‘known’ now ‘known unknown’. The uncertainty that this rapid rate of change ushers in creates the world around extremely fluid.

The most prevalent change that the advent of 21st century has witnessed is the extremely dynamic rate of change. If change was the constant of later part of 20th century, it is almost becoming beyond human comprehension rapid rate of change that is becoming the new-normal with passing of every year of the present century. This rapid change is making what w=is already ‘known’ now ‘known unknown’. The uncertainty that this rapid rate of change ushers in creates the world around extremely fluid.

where we’re weak and then work to strengthen those aspects of our life – personal and professional…Choose to embrace and engage those opportunities now while placed in front of us. Embrace these opportunities even though they may seem a little uncomfortable….And as we grow, the positive possibilities will grow even more superlative in our world.

where we’re weak and then work to strengthen those aspects of our life – personal and professional…Choose to embrace and engage those opportunities now while placed in front of us. Embrace these opportunities even though they may seem a little uncomfortable….And as we grow, the positive possibilities will grow even more superlative in our world.